Liquid biopsy is a non-invasive medical procedure which holds the ability to detect the presence of molecular cancer biomarkers in biological fluids. The report includes market estimation for tests/services, instruments, kits and consumables used for liquid biopsies of different oncology and non-oncology disorders.

The global liquid biopsy market was estimated to be at $2,508.2 million in 2021, which is expected to grow with a CAGR of 19.83% and reach $19,066.0 million by 2032. The growth in the global liquid biopsy market is expected to be driven by increasing adoption of NGS in various research fields, advancement in NGS, and increase in the adoption of personalized medicine.

Recent Developments in the Global Liquid Biopsy Market

• Product Launch in 2020: Sysmex Corporation launched liquid biopsy RUO kits in EMEA region. The kits name is Plasma-SeqSensei, and it is used for non-small cell lung cancer (NSCLC), melanoma, and thyroid cancer.

• Partnership: In 2021, Illumina, Inc. collaborated with Bristol Myers Squibb to innovate and enhance companion diagnostics for therapy selection to further precision oncology. TSO 500 ctDNA is one of the first liquid biopsy assays to enable comprehensive genomic profiling for therapy selection.

• Collaboration: In 2021, QIAGEN collaborated with Sysmex Corporation for the development and commercialization of cancer companion diagnostics using NGS and Plasma-Safe-SeqS technology.

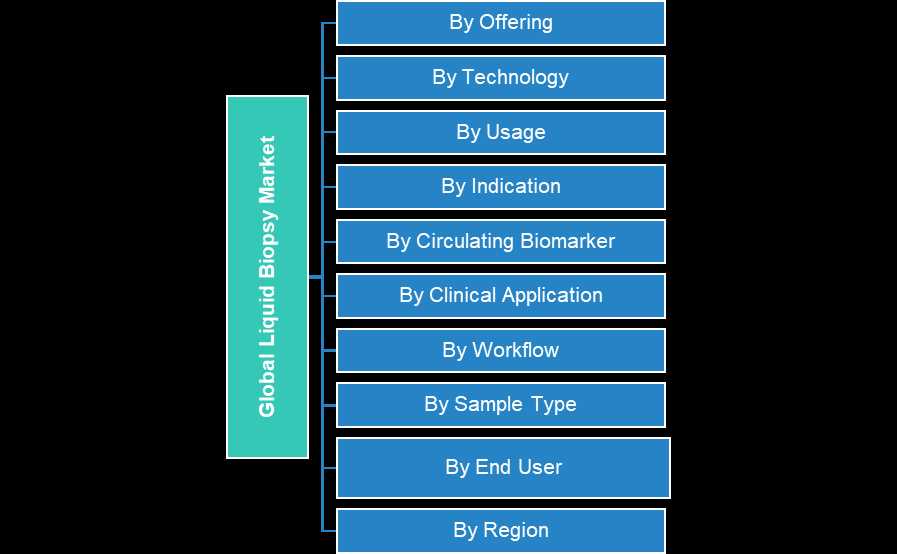

Global Liquid Biopsy Market Segmentation

Demand – Drivers and Limitations

Following are the demand drivers for the liquid biopsy market:

• Rising Cancer Prevalence

• Increasing Adoption of Inorganic Growth Strategies in the Market

• Increase in Research Funding from National Cancer Institute

The market is expected to face some limitations too due to the following challenges:

• Uncertain Reimbursement and Regulatory Policies

• Expected Implementation of Patient Protection and Affordable Care Act in the U.S

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

The top segment players include liquid biopsy manufacturers and service providers that capture around 95% of the presence in the market.

Some of the prominent names established in this market are:

• Abcodia Ltd.

• Bio-Rad Laboratories, Inc.

• Biocept, Inc.

• Dxcover Limited

• Elypta

• Epic Sciences

• F. Hoffmann-La Roche Ltd

• Guardant Health

• Illumina, Inc.

• Laboratory Corporation of America Holdings

• LungLife AI, Inc.

• Micronoma

• Natera, Inc.

• Neogenomics Laboratories

• PerkinElmer Inc.

• QIAGEN

• Sysmex Corporation

• Thermo Fisher Scientific Inc.

Get Free Sample Report - https://bisresearch.com/requestsample?id=1303type=download

Key Questions Answered in the Report

- What are the major market drivers, challenges, and opportunities in the global liquid biopsy market?

- What are the key development strategies which are implemented by the major players to sustain in the competitive market?

- Which is the dominant product type developed by the leading and emerging players for liquid biopsy?

- What are the key technologies that have been used by leading players in the global liquid biopsy market to develop diagnostic and research solutions for cancer?

- How is each segment of the market expected to grow during the forecast period from 2022 to 2032? Following are the segments:

- Offering (testing service, kits, other consumables, and platform)

- Technology (next-generation sequencing (NGS), polymerase chain reaction (PCR), other technologies, and emerging technologies)

- Usage (research and clinical)

- Circulating Biomarker (circulating tumor cells, cell-free DNA, circulating cell-free RNAs, exosomes and extracellular vesicles and others, and other circulating biomarkers)

- Workflow (sample preparation, library preparation, sequencing, and data analysis and management)

- Sample (blood, urine, saliva and others)

- Indication (lung cancer, breast cancer, prostate cancer, colorectal cancer, melanoma, other types of cancer, and non-oncology disorder)

- Clinical Application (treatment monitoring, prognosis and recurrence monitoring, treatment selection and diagnosis and screening)

- End User (academic and research institutions, clinical laboratories, pharmaceutical and biotechnology companies, and other end users)

- Region (North America, Europe, Asia-Pacific, Latin America and Middle East, and Rest-of-the-World)

- Which companies are anticipated to be highly disruptive in the future, and why?

- What are the reimbursement scenario and the regulations for liquid biopsies globally?

- Considering next-generation sequencing (NGS), what is the most important factor among price, sensitivity, and turnaround time, to increase the adoption of NGS-based liquid biopsy in the near future?

- From the end-users’ point of view, does efficiency or convenience hold the key to driving the global liquid biopsy market?

- What are your treatment guidelines for the different types of cancer?

- What is the average number of liquid biopsies being conducted on each patient throughout the duration of their stay?

BIS Related Studies

NGS Sample Preparation Market - A Global and Regional Analysis